Unlocking Financial Freedom: Invoice Factoring Loans

In today’s fast-paced business world, having access to quick cash solutions can make all the difference in the success of your company. One such solution that has been gaining popularity among businesses of all sizes is invoice factoring loans. These loans offer a unique way for businesses to unlock financial freedom and keep their operations running smoothly.

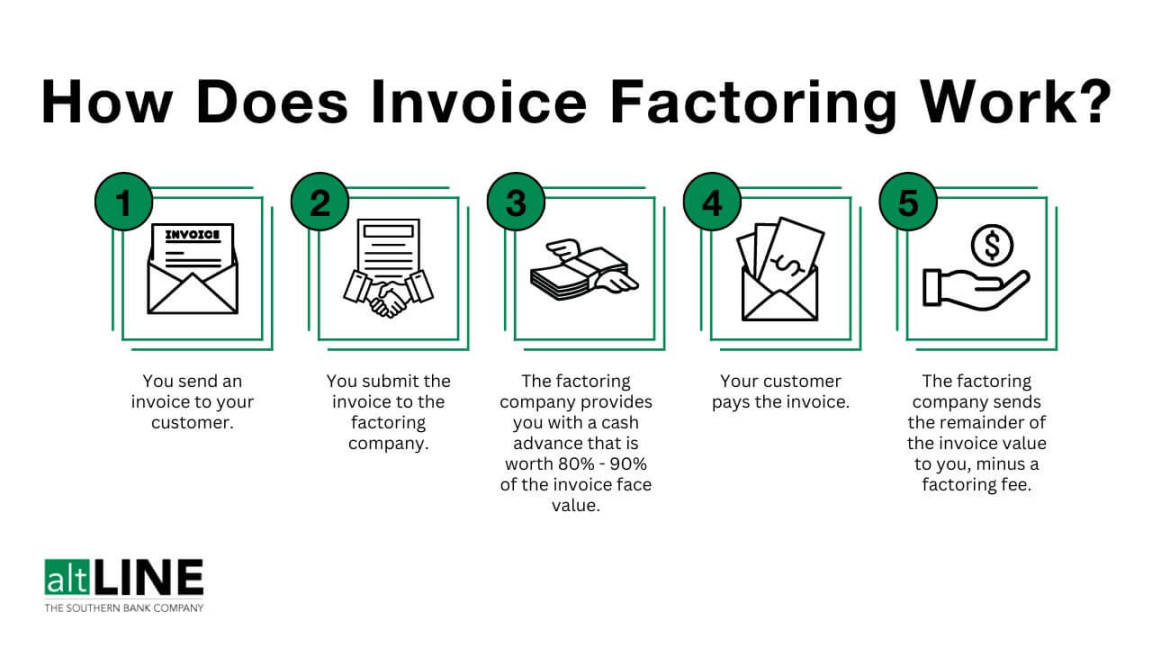

So, what exactly are invoice factoring loans? Essentially, they involve selling your accounts receivable to a third-party financial institution, known as a factor, at a discounted rate. In return, the factor provides your business with an immediate cash advance, allowing you to meet your short-term financial needs without having to wait for your customers to pay their invoices. This can be especially helpful for businesses that experience cash flow gaps or need to fund growth opportunities quickly.

One of the key benefits of invoice factoring loans is that they are relatively easy to qualify for, making them a viable option for businesses that may not qualify for traditional bank loans. Factors typically look at the creditworthiness of your customers rather than your own credit history, making it a more accessible financing option for businesses with less-than-perfect credit.

Additionally, invoice factoring loans can be a more flexible financing solution compared to traditional loans. Since the amount you can borrow is based on the value of your accounts receivable, your borrowing capacity can increase as your business grows. This means that as your sales increase and you generate more invoices, you can access more cash to support your operations.

Another advantage of invoice factoring loans is that they can help improve your cash flow management. By receiving immediate payment for your invoices, you can better plan and budget for your business expenses, ensuring that you have the funds needed to cover payroll, purchase inventory, or invest in new equipment. This can ultimately help your business run more smoothly and efficiently, reducing the stress and uncertainty often associated with managing cash flow.

Furthermore, invoice factoring loans can help you avoid taking on additional debt. Since you are essentially selling your accounts receivable rather than borrowing money, you won’t be adding to your existing debt load. This can be especially beneficial for businesses that are already carrying a significant amount of debt or are looking to avoid taking on more debt in the future.

Overall, invoice factoring loans can be a valuable tool for businesses looking to unlock financial freedom and take their operations to the next level. By providing quick access to cash, improving cash flow management, and offering a flexible financing solution, these loans can help businesses of all sizes navigate the ups and downs of the business world with confidence and ease. So, if you’re looking for a quick cash solution to help your business thrive, consider exploring the benefits of invoice factoring loans today.

Boost Your Business with Quick Cash Solutions

In the fast-paced world of business, having quick access to cash can make all the difference between success and failure. Whether you are a small startup or a well-established company, the need for immediate funds can arise at any moment. This is where invoice factoring loans can come to the rescue and provide your business with the quick cash it needs to thrive and grow.

Invoice factoring loans, also known as accounts receivable financing, is a financial tool that allows businesses to sell their unpaid invoices to a third-party company, known as a factor, at a discounted rate. In exchange, the factor advances a certain percentage of the invoice value to the business, typically within 24 to 48 hours. This provides businesses with immediate access to much-needed cash flow, without having to wait for their customers to pay their invoices.

One of the biggest advantages of invoice factoring loans is the speed at which funds are made available. Traditional bank loans can take weeks or even months to be approved and disbursed, which can be detrimental for businesses that need cash quickly. With invoice factoring, businesses can have cash in hand within days, allowing them to seize new opportunities, cover unexpected expenses, or simply improve their day-to-day operations.

Furthermore, invoice factoring loans are not based on the creditworthiness of the business, but rather on the creditworthiness of its customers. This makes it an accessible financing option for businesses with less-than-perfect credit scores or limited operating history. As long as a business has unpaid invoices from creditworthy customers, they can qualify for invoice factoring loans and access the quick cash they need to fuel their growth.

Another key benefit of invoice factoring loans is the flexibility it offers to businesses. Unlike traditional loans that come with fixed repayment terms, invoice factoring is a revolving line of credit that grows with the business. As businesses generate more invoices, they can continue to sell them to the factor and access more cash as needed. This flexibility allows businesses to tailor their financing to their specific needs and take advantage of growth opportunities as they arise.

In addition to providing quick cash solutions, invoice factoring loans can also help businesses improve their cash flow management. By outsourcing the collection of unpaid invoices to the factor, businesses can free up valuable time and resources that would have otherwise been spent on chasing down payments. This allows businesses to focus on what they do best – running and growing their business – while the factor takes care of the rest.

Overall, invoice factoring loans can be a game-changer for businesses looking to boost their cash flow and take their operations to the next level. With its quick and easy access to cash, flexible financing options, and ability to improve cash flow management, invoice factoring can help businesses navigate the ups and downs of the business world with ease. So why wait? Boost your business with quick cash solutions today and unlock the full potential of your operations.