Healing with Ease: The Benefits of Medical Expense Loans

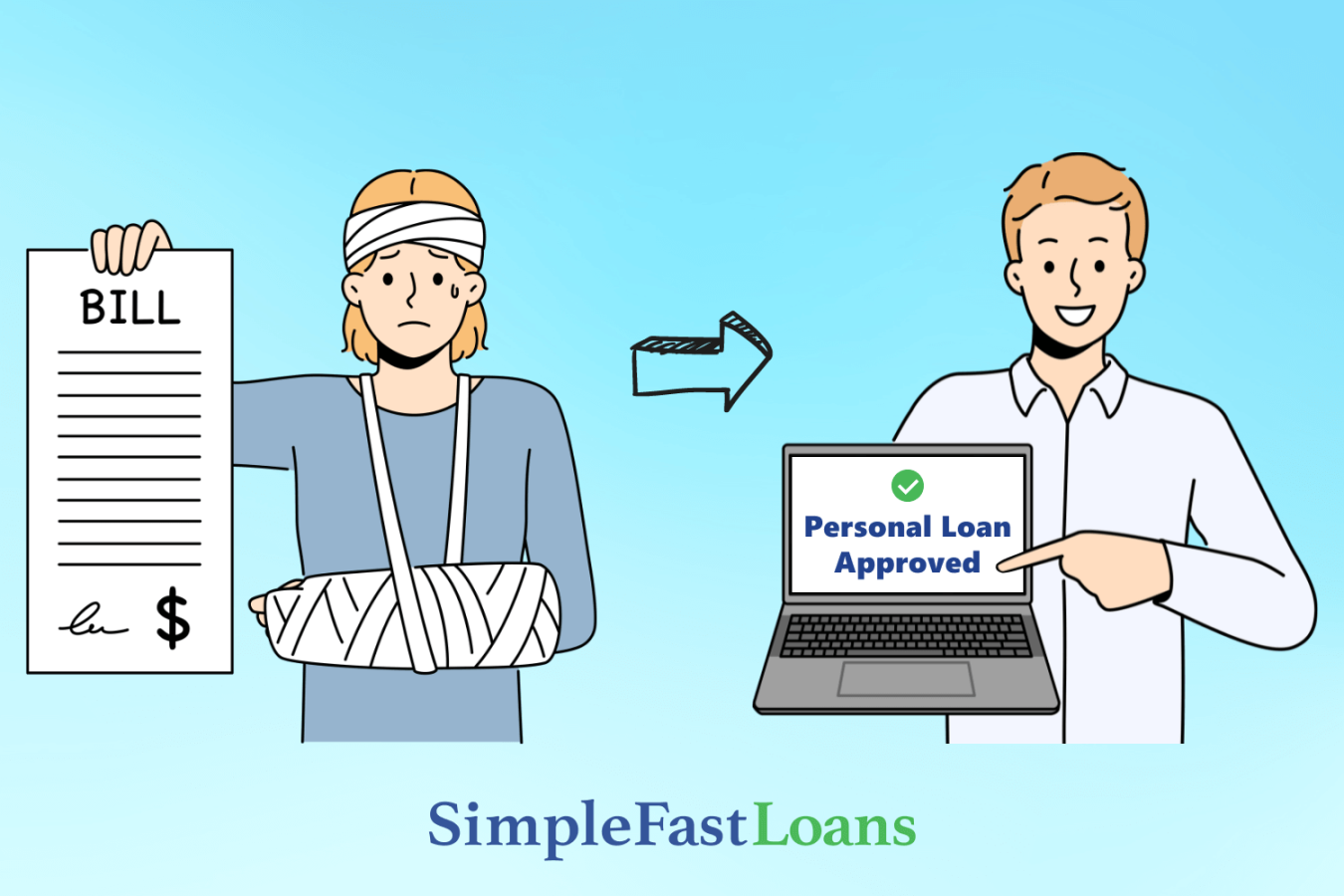

Facing a medical emergency can be a stressful and overwhelming experience, especially when the burden of medical bills starts piling up. In times of crisis, the last thing you should have to worry about is how you are going to afford the necessary medical treatment. That’s where medical expense loans come in to provide a helping hand and ease the financial strain that often accompanies health issues.

Medical expense loans are a valuable resource for individuals who find themselves in need of immediate funds to cover medical bills. These loans can be used to pay for a wide range of medical expenses, including hospital stays, surgeries, medications, and other treatments. By taking out a medical expense loan, you can focus on your recovery without having to stress about the financial aspect of your healthcare.

One of the key benefits of medical expense loans is the quick access to funds that they provide. In many cases, medical emergencies require immediate attention, and waiting for insurance claims to be processed or savings to accumulate is simply not an option. Medical expense loans offer a fast and efficient solution to cover the cost of treatment when time is of the essence.

Furthermore, medical expense loans can be tailored to fit your individual needs and financial situation. Whether you require a small loan to cover a single medical procedure or a larger loan to address ongoing health issues, there are options available to suit your specific requirements. This flexibility allows you to access the funds you need without taking on more debt than you can comfortably manage.

In addition to providing financial assistance, medical expense loans can also help to alleviate the stress and anxiety that often accompany medical emergencies. Knowing that you have the means to pay for necessary medical treatment can provide a sense of security and peace of mind during a challenging time. By taking advantage of a medical expense loan, you can focus on your health and well-being without worrying about the impact on your finances.

Another advantage of medical expense loans is that they are typically unsecured, meaning you do not need to put up collateral to secure the loan. This can be particularly beneficial for individuals who do not have valuable assets to use as security or who are hesitant to risk losing their property. With an unsecured medical expense loan, you can access the funds you need without putting your personal belongings at risk.

Overall, medical expense loans offer a lifeline for individuals who are facing unexpected medical bills and need assistance to cover the cost of treatment. These loans provide quick access to funds, personalized loan options, and peace of mind during a challenging time. By taking advantage of a medical expense loan, you can focus on your recovery and healing with ease, knowing that your financial needs are being taken care of.

Say Goodbye to Financial Stress with Medical Bill Assistance

Medical bills can be incredibly stressful to deal with, especially when you or a loved one are facing a health crisis. The last thing you should be worrying about during such a difficult time is how to pay for necessary medical treatment. That’s where medical bill assistance comes in to save the day and help you say goodbye to financial stress.

Medical bill assistance programs are designed to provide financial relief for individuals and families who are struggling to cover the costs of medical care. These programs can help you pay for doctor’s visits, hospital stays, surgeries, medications, and other necessary treatments. They can also help with other related expenses, such as transportation to medical appointments and home health care services.

One of the main benefits of medical bill assistance is that it can help you avoid falling into debt due to high medical expenses. Medical bills can quickly add up, especially if you require ongoing treatment or have a serious health condition. By providing financial assistance, these programs can help you stay afloat and avoid the stress of mounting medical debt.

Another benefit of medical bill assistance is that it can help you access the medical care you need without delay. When you’re struggling to pay for treatment, you may be tempted to postpone or skip necessary medical appointments. This can have serious consequences for your health and well-being. Medical bill assistance can help you get the care you need when you need it, without having to worry about the cost.

Medical bill assistance programs come in many forms, including grants, loans, and payment plans. Some programs are offered by government agencies, while others are provided by nonprofit organizations, charities, and healthcare providers. These programs may have specific eligibility criteria, such as income limits or residency requirements, so it’s important to research your options and find a program that’s right for you.

If you’re considering applying for medical bill assistance, it’s important to gather all the necessary documentation and information before you begin the application process. This may include proof of income, medical bills, insurance information, and other relevant paperwork. Be prepared to provide detailed information about your medical condition and treatment plan, as well as any other factors that may impact your ability to pay for care.

In addition to traditional medical bill assistance programs, there are also alternative options available for those in need of financial support. Medical expense loans are one such option that can help you cover the cost of medical care in a timely manner. These loans are specifically designed to help individuals pay for medical expenses that may not be covered by insurance or other assistance programs.

Medical expense loans work much like traditional personal loans, but with a focus on medical expenses. You can use the funds from a medical expense loan to pay for doctor’s visits, hospital stays, surgeries, medications, and other healthcare costs. These loans typically have competitive interest rates and flexible repayment terms, making them a convenient option for those in need of financial assistance.

In conclusion, medical bill assistance programs and medical expense loans can be valuable resources for individuals and families facing high medical expenses. These programs can provide much-needed financial relief, allowing you to focus on your health and well-being without the added stress of worrying about how to pay for medical care. If you or a loved one is struggling to cover the cost of necessary medical treatment, consider exploring these options to say goodbye to financial stress and get the care you need.