Tap into Your Home’s Equity Today!

Have you ever found yourself in need of some extra cash to fund a home renovation project, pay for unexpected medical expenses, or cover the cost of your child’s education? If so, you’re not alone. Many homeowners face financial challenges that require them to find creative solutions to access the funds they need. One option that is often overlooked is tapping into the equity in your home through a Home Equity Line of Credit (HELOC).

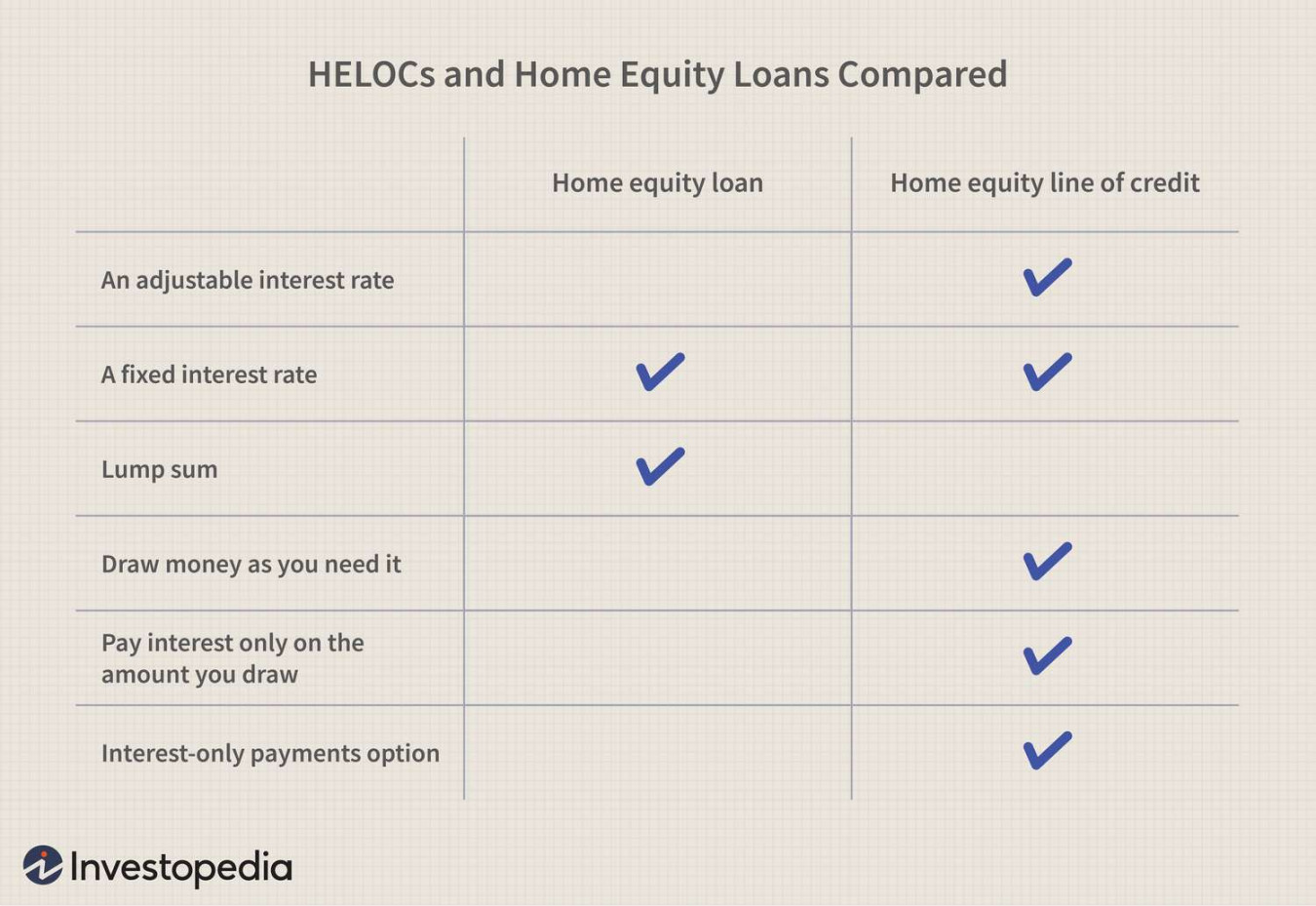

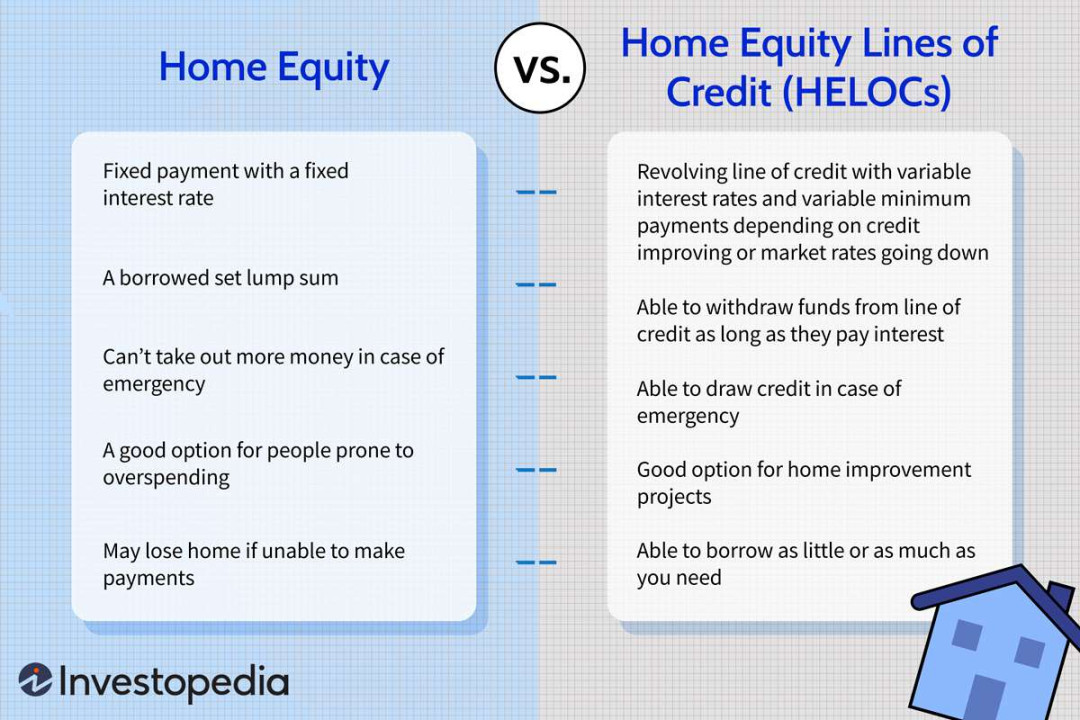

A HELOC is a flexible and convenient way to borrow money using the equity in your home as collateral. Unlike a traditional loan, where you receive a lump sum of money upfront and make fixed monthly payments, a HELOC works more like a credit card. You have a credit limit based on the equity in your home, and you can borrow as much or as little as you need, up to that limit. As you repay the borrowed amount, the funds become available to borrow again, giving you ongoing access to cash when you need it.

One of the biggest benefits of a HELOC is that it allows you to unlock the cash that is tied up in your home without having to sell or refinance. This can be especially helpful for homeowners who have built up equity in their homes over time but find themselves in need of funds for various reasons. Whether you want to make home improvements, consolidate high-interest debt, or simply have a financial safety net for emergencies, a HELOC can provide you with the flexibility and convenience you need.

Another advantage of a HELOC is that the interest rates are typically lower than other types of loans, such as personal loans or credit cards. This can result in significant savings over time, especially if you are using the funds for a large expense or carrying a balance for an extended period. Additionally, the interest you pay on a HELOC may be tax-deductible, making it a cost-effective borrowing option for many homeowners.

To tap into your home’s equity with a HELOC, you will need to apply with a lender and meet certain eligibility requirements. Typically, lenders will look at factors such as your credit score, income, and the amount of equity you have in your home to determine if you qualify for a HELOC. Once approved, you can start using the funds for whatever purpose you need, whether it’s home improvements, debt consolidation, or any other financial need.

In conclusion, if you’re looking for a way to unlock the cash in your home and access funds when you need them, a HELOC can be a valuable tool to consider. With its flexibility, low interest rates, and potential tax benefits, a HELOC offers homeowners a convenient and cost-effective way to borrow money using the equity in their homes. So why wait? Tap into your home’s equity today and discover the financial freedom and peace of mind that comes with having access to the funds you need.

Discover the Benefits of a HELOC Loan!

Are you looking to unlock the cash in your home? One of the best ways to do so is by getting a Home Equity Line of Credit (HELOC) loan. This type of loan allows you to borrow against the equity in your home, giving you access to funds that can be used for a variety of purposes.

One of the key benefits of a HELOC loan is its flexibility. Unlike a traditional home equity loan, which gives you a lump sum of money upfront, a HELOC allows you to borrow as much or as little as you need, up to a certain limit. This can be incredibly useful if you have ongoing expenses or if you’re not sure exactly how much money you’ll need.

Another benefit of a HELOC loan is its low interest rates. Because the loan is secured by your home, lenders are able to offer lower interest rates than you would typically find with other types of loans. This can save you a significant amount of money in the long run, especially if you’re borrowing a large sum of money.

Additionally, a HELOC loan can be a great way to consolidate debt. If you have high-interest credit card debt or other loans with unfavorable terms, you can use a HELOC to pay off those debts and then make one monthly payment at a lower interest rate. This can help you save money and pay off your debts more quickly.

One of the lesser-known benefits of a HELOC loan is its potential tax advantages. In some cases, the interest you pay on a HELOC loan may be tax-deductible, which can further reduce the cost of borrowing. It’s always a good idea to consult with a tax professional to see if you qualify for this deduction.

Another advantage of a HELOC loan is that it can be used for a wide range of purposes. Whether you’re looking to make home improvements, pay for a major expense, or even fund a vacation, a HELOC loan gives you the flexibility to use the funds however you see fit. This can be especially helpful if you have a variable or unpredictable income.

Finally, a HELOC loan can be a great way to access cash in an emergency. If you have unexpected expenses or need money quickly, having a HELOC in place can provide you with a convenient source of funds. This can give you peace of mind knowing that you have a financial safety net in place.

In conclusion, a HELOC loan can be a valuable tool for homeowners looking to unlock the cash in their homes. With its flexibility, low interest rates, potential tax advantages, and ability to be used for a wide range of purposes, a HELOC loan offers numerous benefits that can help you achieve your financial goals. If you’re interested in tapping into the equity in your home, consider exploring the benefits of a HELOC loan today.